Thinking of Buying a “Second Home” in Puerto Vallarta

From Homes & Living Magazine

I) Compensate the insured party for losses suffered, whenever said loss or damage does not result from titling or deeding problem that had been expressly exempted from the policy. Perhaps you are considering retiring in a few years and owning a vacation home. Or maybe you are among the younger set, with children and see this city as a family investment that will render strong dividends.

Puerto Vallarta offers all the necessary services and needs of health, security, and entertainment that we all require for our loved ones and ourselves.

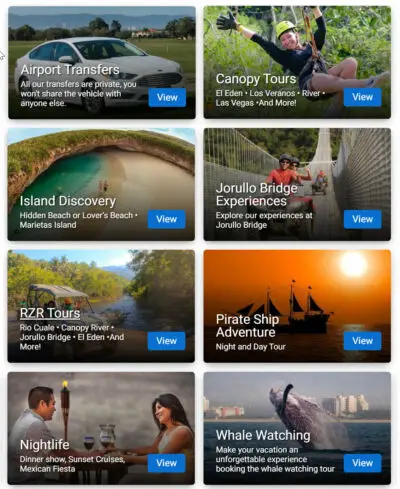

There are outstanding developers in the present-day real estate market of Puerto Vallarta who are creating a wide range of offerings for investors, who not only seek a vacation option, but also an investment choice supported by attractions of beautiful natural landscapes and activities such as sports fishing, golf, and all types of navigation. There are many choices in terms of investment and Puerto Vallarta possesses the greatest potential of the Pacific coast with its unlimited attractions that allow travellers to find something new every time they return.

You will be enchanted by the bay that is a paradise of intense colours and exuberant –beaches. Explore the natural land and submarine wonders.

The new real estate market not only offers residential alternatives for personal reasons but as a short and medium-term investment as well.

Acquiring real estate isn’t just buying a house of a certain style anymore; it is an important decision from a financial and investment perspective.

To acquire real estate not only implies making a decision about the style of home we wish to purchase but also means making a crucial decision from an investment and financial point of view.

The real estate industry in Puerto Vallarta is one of the most prosperous on the national and international level; it is growing year by year and had very good results in 2004. The similarity between the real estate professional development in Mexico and in the United States gives us an idea of the importance of this sector in Mexico. The Mexican Association of Professional Realtors (AMPI) is the only real estate association similar to the National Association of Realtors (NAR) in the United States.

The real estate market stands out for being a safe and patrimonial investment and offers very good dividends to investors. The best opportunities for making money in a country like Mexico exist when the investment instruments offer low yield rates and the stock market is unstable because Mexico is known for having extensive guarantees to satisfy the required security of investors. The present governmental administration is giving all its support to facilitate the bureaucratic procedures. Sometimes it is easier to purchase a property in Mexico than in the United States or Canada since the buying-selling process is carried out through specialized real estate agencies and a notary public who validates and certifies all the transactions.

Buying property in Vallarta

We all dream of someday owning a piece of beach property for vacations, or for the day we retire from long years of work. In the past, the only way one could acquire property was with cash payment. Now, the possibility exists to acquire property with banking credit or direct financing on the part of the developers.

Nonetheless, it is important to define what you are going to buy (house, villa, land, or an apartment). It is important to know what your budget is, if financing exists, who will counsel you, in short, there are a series of relevant aspects that should be reviewed by experts in their corresponding field. It is necessary to know and understand Mexican laws to be able to protect your investment. For foreigners, in any case, the purchase must be made through a Fideicomiso (Trust contract).

What is a Trust Contract?

The objective of the trust contract is to preserve the rights of the buyer who acquires guaranteed rights and administration of property. In the case of foreigners, the trust contract is made because there are restrictions regarding direct ownership of land. The trust contract also guarantees legal security with regard to possession of the property. This contract must be registered in the presence of a notary public and with the respective permission from the Secretary of Foreign Relations here in Mexico.

To initiate a trust contract, you start with a minimum payment to form the trust association with a bank and also a payment based on a percentage of the property’s value. The bank will charge an annual fee (which depends on the estimated value of the property), which pays for the expenses of their services. A trust contract lasts 50 years, and it can be extended.

Important aspects of the buying and selling of real estate

It is essential that a notary public is involved in the process. He is a go’

The governmental representative certifies and carries out all the sales contracts processes, which happen upon the transferal of deed ownership from one person to another. It is also a guarantee that the notary public is the responsible agent of the property since this protects the interests of the buyer as well as the seller. The following documents must be given to the notary public so he may be able to process any transaction; a complete appraisal of the property so as to calculate the amount of taxes to pay, a letter from the municipal treasury stipulating that water bills and property tax payments have been paid up to date, and a certificate of no existing liens from the Public Registry of Property.

Presently, Mexican laws impose a 33% tax payment on the difference between the registered purchase price and sale price (less authorized deductions and inflation compensation). Nonetheless, there is the option that the seller pays a 25% tax on the total value of the transaction, without deductions.

Beginning in 2004, the only way a foreign seller can be exempt from the capital gains tax payment is by proving that he or she is a resident of Mexico. In the case of another residence outside of Mexico, he or she must show that their main economic activity takes place in Mexico. There must be proof that 50% of their annual income originates in Mexico or that their main professional activity is in this country.

A guide to acquiring property safely

1- The first step is to retain the services of a specialized real estate company that will charge a 6 to 8% commission based on the property’s value. You must also choose a trusted notary public.

2- Look for the abbreviations AMPI in the real estate company’s description, so that there will be a guaranteed in-depth legal review. This will facilitate the transaction since the closing period is fundamental.

3- Make clear that the seller is in charge of all closing costs, including expenses, taxes, and fees.

4- Analyze all financing possibilities. Now there is direct financing on short and medium terms for Mexican and foreigners. Foreigners also have mortgage credits to buy or build their vacation homes in Mexico. This type of financing is available from firms such as Collateral Mortgage LTD, which grants credits of up to 50% of the value of the property, starting at $400.000.00 USD and for 20 years, to American citizens who wish to build, remodel or purchase a vacation property in Mexico.

Another way in which foreigners obtain funds to purchase real estate in our country is by obtaining financing using properties or assets in their home country as collateral.

The minimum down payment is 30%, and the annual interests start at 8.75%. The minimum credit is for the amount of $100.000.00 USD and the maximum is $800.000.00 USD.

5- The notary public acts as the responsible agent of the real estate property. It is not generally common to have title insurance but there are Mexican and foreign companies which do offer this service. Stewart Title Insurance is the most important company of this kind in Puerto Vallarta.

Having title insurance guarantees validity and priority of their rights on the property to the insured party (owner, trust holder, or mortgagee). It is also an indemnification contract between the insured and the company that issues the policy. An insurance title is also a detailed analysis and evaluation of the public and private documents and plans relating to the property’s deed.

In the case of loss or adverse complaint to the title insurance policy issued by a company, that company is obligated to:

II) Pay the legal costs of defence and protect the insured party faced with any claim that questions the validity and preference of their rights on the property.

Last Updated on 26/10/2021 by Puerto Vallarta Net

Leave A Comment